what is meant by open end mortgage

A closed mortgage is pretty much the opposite of an open one. Its kind of like a mortgage and home equity line of credit HELOC rolled into one loan when a.

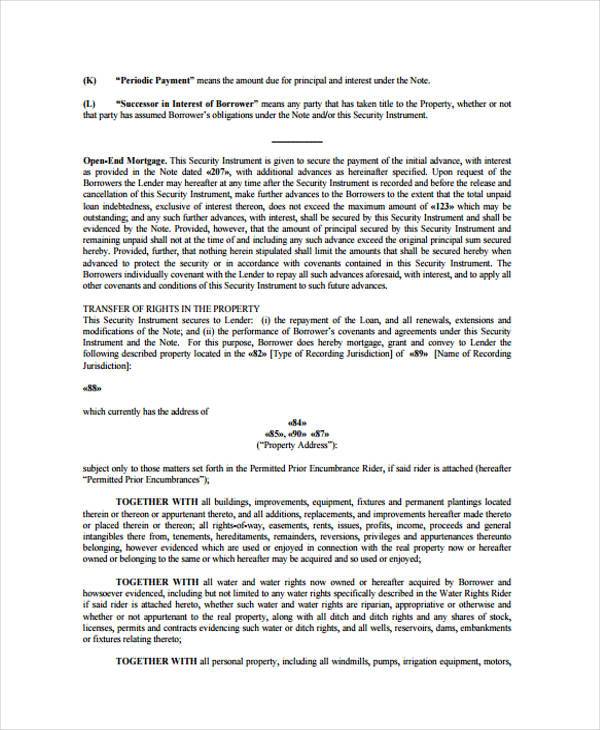

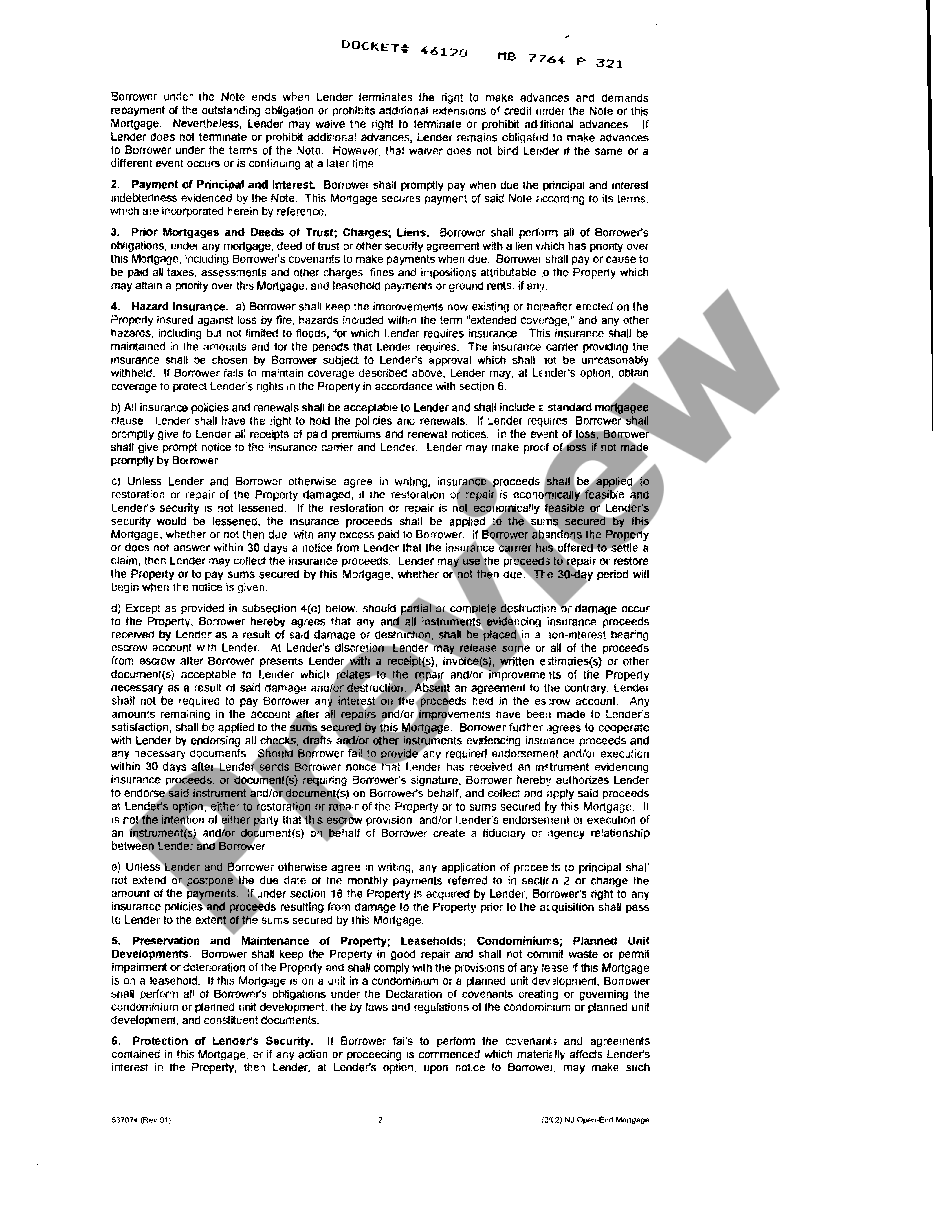

Appendix G To Part 1026 Open End Model Forms And Clauses Consumer Financial Protection Bureau

The open-end mortgage is a type of mortgage that is more flexible for the mortgagee and more giving unlike a closed-end mortgage.

. You cant pay off the loan early. An open-end mortgage is also sometimes called a home improvement loan. A mortgage that allows the borrowing of additional sums often on the condition that a stated ratio of collateral value to the debt be maintained.

An open-end mortgage is a type of home loan in which the total amount of the loan is not advanced all at once but rather used for future home-related. The open-end mortgage is a type of mortgage that is more flexible for the mortgagee and more giving unlike a closed-end mortgage. A mortgage loan that may allow future advances as the value of the property increases up to a certain percentage of loan-to-valueThe legal problem with this arrangement.

The open-end mortgage is a type of mortgage that is more flexible for the mortgagee and more giving unlike a closed-end mortgage. An open mortgage is a mortgage loan where the holder can have a loan for the maximum amount of the principal that was amortized at a certain time generally it is produced. This a 2nd lien against your property.

Open-End Mortgage is an example of a term used in the field of economics Economics -. Meaning of Open-End Loan. Its called open end because there is no set term for the.

Open-end mortgage saves borrower the. An open-end mortgage allows. An open-end loan is a preapproved loan between a financial institution and a borrower that can be used repeatedly up to a certain limit and then.

It remains open and it. Closed mortgages have more restrictions and limited flexibility for borrowers. The Termbase team is compiling.

The Termbase team is compiling practical examples in using Open-End Mortgage. The borrower can choose the amount he wants to take to purchase the property. An open-end mortgage is a type of mortgage loan deed that allows the borrower to increase the amount of outstanding mortgage principal in advance or at a future date.

A mortgage that allows the borrowing of additional sums often on the condition that a stated ratio of collateral value to the debt be maintained. A mortgagee through an open-end. An open end mortgage usually refers to a Home Equity Line of Credit or HELOC.

Open-end mortgage allows the borrower to borrow additional money on the same loan amount up to a certain limit. An open-end mortgage allows individuals to borrow additional money on the same loan at a later date without having to take out new financing or credit. Open-end loans provide the borrower with the highest amount of loan they can obtain in a given period.

Exhibit 10 171 Open End Mortgage

Free 10 Security Agreement Forms In Pdf Ms Word

Mortgages Archives Investingfuse

New Jersey Open End Mortgage Open End Mortgage Us Legal Forms

What Is An Open End Mortgage The Real Estate Decision

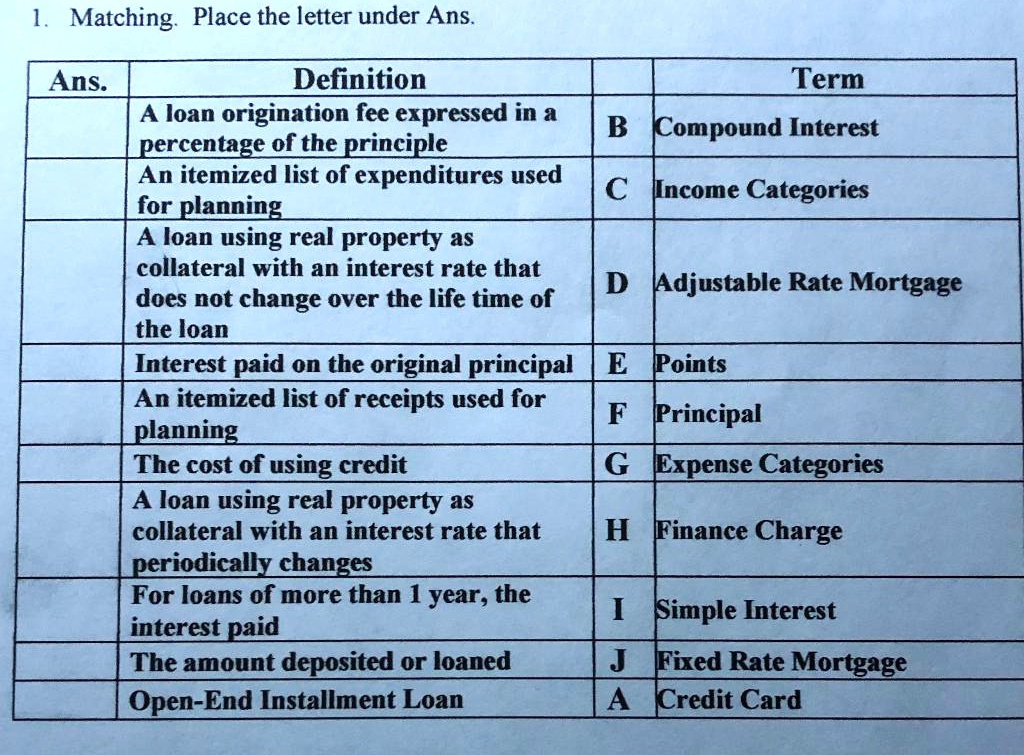

Solved Matching Place The Letter Under Ans Ans Definition Term Loan Origination Fee Expressed In B Kompound Interest Percentage Of The Principle An Itemized List Of Expenditures Used Income Categories For Planning

Open End Mortgage Heloc Ppt Powerpoint Presentation Professional Outline Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

Motion For Extension Of Time December 17 2010 Trellis

Open End Mortgage And Security Agreement Bgdailynews Com

Loan Vs Mortgage Difference And Comparison Diffen

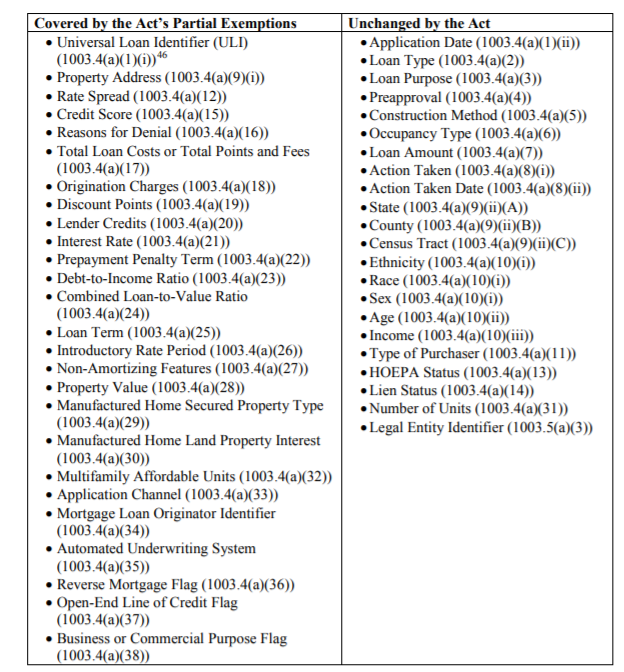

Bcfp Issues Rule Implementing S 2155 Hmda Exemptions Nafcu

:max_bytes(150000):strip_icc()/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed End Credit Vs An Open Line Of Credit

Open End Mortgage Flashcards Quizlet

Mlo Mentor Section 35 Loans Firsttuesday Journal

How Many Names Can Be On A Mortgage

Defendant Firstmerit Bank S Answer To Complaint November 23 2005 Trellis

/GettyImages-931812572-a67e660bd8c2476a9d7f87e76a97b158.jpg)